Importing windows from Poland to the USA: documents and formalities

Every third window that has been exported was produced in Poland. Our country is the European leader and a global runner-up in the exportation of fenestration products. Despite that, many American entrepreneurs associate sea transport from this place with a pile of documents and intricate formalities whose cost outweighs the profits. But are these fears and assumptions correct?

After reading this article you will know:

- What are the potential shipping costs

- What is the difference between a freight forwarder and a shipowner, and what Incoterms are

- What are your responsibilities and what are the duties of the freight forwarder

- What is the difference between the CIF rule and the DAP rule that debesto uses

- Which documents are needed to import windows from Poland to the USA

- What you need to remember when collecting goods from the port

Importing windows from Poland to the U.S. seems very complicated at first glance, but according to Wojciech Stanowski, owner of debesto – it’s as convenient and simple as buying a plane ticket, of course, if you yourself have years of experience in importing products from Poland or cooperate with a trusted partner.

Considering importing windows from Poland?

We assume that if you have everything in your little finger, you wouldn’t have come across this article, but since you’re here, it means that you’re seriously considering importing windows from Poland – check out its benefits.

Why should you import windows from Poland?The first question you are probably asking yourself is – what is the cost of importing a container from Poland to the US?

The current estimated price of transporting a 20-feet container is about 6,000 USD – 7,000 USD, with a 40-foot container the amount rises to 7,000 USD – 9,000 USD, but debesto’s competitive pricing will save you up to four times on shipping.

Who is who and what are they responsible for?

- Freight Forwarder — organizes transportation of your cargo to the starting port, and takes care of the formalities

- Ship-owner — is responsible for transporting the goods by a ship, freight forwarder has direct contact with them

- Incoterms — a set of international commercial terms that define the division of duties and responsibilities of the buyer and the seller

Remember to check which Incoterms rules are used by the certain freight forwarder, or try to establish those terms with them.

What rules does debesto.com use?

debesto bases its services on CIF (Cost, Insurance and Freight) terms, which means that the seller covers the costs of the export customs duties, and pays for the packaging and transportation of goods. They also buy an insurance policy and sign a transport contract with the shipowner. You are responsible for handling and paying for customs clearance and the costs of import at the destination port (or for hiring a customs agent to do these formalities for you).

Our company also offers DAP (Delivered at Place), under the DAP rule, you are responsible for import customs clearance and all applicable duties and taxes once the cargo arrives at its destination, and the seller arranges transportation, handles export clearance and delivers the goods ready for unloading to the place you specify, while bearing all costs associated with this delivery.

Note that with the Incoterms listed, your and the shipper’s responsibilities differ – for this reason you will have to take more or less steps related to the whole process. In the rest of this article we will focus precisely on the rules listed above and explain them to you in detail.

DISTRIBUTION OF RESPONSIBILITIES IN CIF INCOTERMS

| YOUR DUTIES | DUTIES OF YOUR FREIGHT FORWARDER |

| You provide the freight forwarder with all necessary documents and pay for the additional records or certificates if the situation requires it | They are responsible for the transportation, packaging and loading of your goods on the ship and covers the related costs |

| You are responsible for the import customs clearance | They sign and pay for the cost of the freight and insurance contract |

| You pay import customs duties and cover other terminal operation charges | They are responsible for the export customs clearance at the original port |

| You cover costs that were not included in the contract you signed with the seller | They will notify you about the steps and actions which are necessary for the hassle-free reception of the goods at the final port |

DISTRIBUTION OF RESPONSIBILITIES IN DAP INCOTERMS

| YOUR DUTIES | DUTIES OF YOUR FREIGHT FORWARDER |

| You pay for the goods, provide all the necessary documents and bear any costs associated with obtaining additional documents needed by the shipper | Responsible for transporting, packing and loading the goods onto the ship and paying the associated costs until the cargo is delivered to the specified location |

| You organize the import clearance, cover its cost, you also have to obtain all the necessary documents for the clearance and pay for it if needed | Bears export clearance costs and potential unloading costs |

| You inform the seller of the time and place where the goods are to be delivered, you are responsible for unloading them | Arranging transportation to your specified location |

| You are responsible for damage or loss of goods after you receive them | Bears the costs for damage or loss of the goods until they are delivered to the place you specify |

Import documents in practice – CIF Incoterms

- After choosing the freight forwarder, you must provide them with the following data and documents:

- EORI number of your company — required for communication with the customs authorities of the European Union. If you do not have it, submit an application at https://puesc.gov.pl/en/puesc,

- Commercial invoice – in English (if the original version is in a different language also attach it

- Packing list (specification of the goods) – the data on the packing list must match the figures stated on the commercial invoice

- Power of Attorney — written authorization for the customs broker from the USA to perform the customs clearance on your behalf (you need to find a suitable agent yourself or outsource this task to your freight forwarder)

- How to avoid additional costs?

Contact the freight forwarder and establish the following:

- the container number, for example, ABCD1234567, allows you to follow the route of the goods and prepare for their collection from the final destination

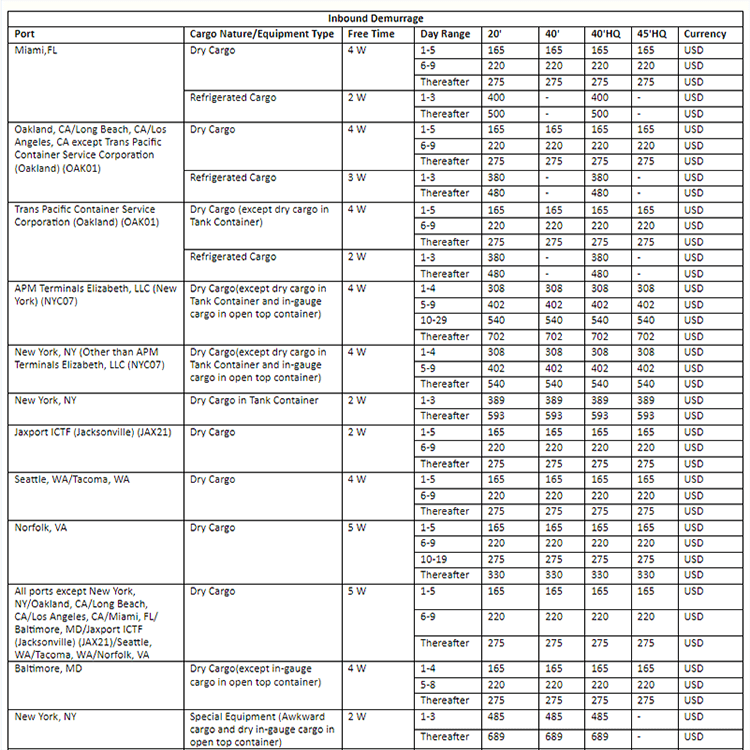

- the allowed storage time of the container in the port (the so-called Free Days / Free Time), as each ship-owner has its own arrangements:

- Free time may vary from 2 to even 14 working days

- The freight forwarder can usually negotiate these terms with the ship-owner at your request

- When the storing of your container exceeds the allowed storage time at the port, you will have to pay the Demurrage Fees for each day your container stays there. these charges vary depending on the destination port and the container size but they fluctuate between 75 and 800 USD per day

- The time period to return the container to the port also depends on the given terminal and usually spans from 2 to 5 working days (some terminals use calendar days also), after that time passes you have to pay Detention Fees

For illustration – Free Days and Demurrage Fees of the Orient Overseas Container Line in sample US ports

Customs duties and cooperation with a customs agent

- The customs agent will take care of the formalities and customs clearance at the final port, debesto’s logistician Jacek Łyczewski explains: „A customs agent will guide you through local duty and state-specific tax. They will also determine the method of picking up the goods upon their arrival at the final port.”

- Bill of Lading — sea waybill issued by the ship-owner, it serves as a permit for you to collect the cargo from the port. Bill of Lading can be issued in electronic form, you can notify the freight forwarder for a Bill of Lading to be issued on behalf of your authorized customs agent; this document is usually issued within 2-3 working days from the departure of the goods from the starting port

How to organize an efficient pick-up of goods in the USA?

From the moment the windows are in the US, you will be responsible for the next steps:

1. You have to collect the goods from the port within the deadline set by the shipowner (usually 48-72 hrs after the container arrives at the port)

2. Pay US Customs Duty (ask your customs agent for the current rate)

3. Arrange and pay for transport from the port to the investment site/warehouse

4. Pay terminal handling cost:

- in the case of groupage, less container load (LCL – usually in OSB crates) it will be an estimated 3 USD per ft3 to 6 USD per ft3 of goods

- in the case of full-container transport (FCL – the entire container for the exclusive use of one customer), the costs of port service are usually already included in the price of transport.

5. On the spot, check that the quantity and quality of the packages. Take photos of the goods in the packages and after opening them in case of possible damages.

If you are having trouble finding the right freight forwarding company to deliver the goods to your destination, ask your customs agent on the U.S. side, they should be able to help you with this issue.

It is important to pick up the goods as soon as possible after unloading at the port. The penalty for holding the goods at the harbor for a day can be several hundred dollars, so contact the choosen shipping company in advance so they will deliver the goods to the construction site as soon as they are unloaded from the ship. You may have to wait up to several days for the ship to unload at the port.

Import documents in practice – DAP Incoterms

- After choosing the freight forwarder, you must provide them with the following data and documents:

- EORI number of your company — required for communication with the customs authorities of the European Union. If you do not have it, submit an application at https://puesc.gov.pl/en/puesc,

- Commercial invoice – in English (if the original version is in a different language also attach it

- Packing list (specification of the goods) – the data on the packing list must match the figures stated on the commercial invoice

2. If you want your goods to be insured, you must purchase an insurance policy

3. Due to the fact that you have to organize import customs clearance yourself, you must take responsibility for completing all the necessary documents, another option is to use the services of a customs agent:

- Importer ID Number (also known as Customs Assigned Number) – a number assigned by U.S. Customs, it is used by U.S. Customs to, eg. determine bond coverage, release and entry of goods, or issue bills, you can obtain it by completing CBP Form 5106 through the Automated Commercial Environment (ACE) Secure Data Portal or submit it by mail

- Commercial invoice – in English (if the original version is in a different language also attach it)

- Packing list (specification of the goods) – the data on the packing list must match the figures stated on the commercial invoice

- Bill of Lading – a sea waybill issued by the shipowner

- Proof of insurance (if you have bought a policy)

- ISF (Importer Security Filing) 10+2 – the data for this document should be sent to you by the shipper, you must report it to customs no later than 24 hours before the ship sets off from the port of departure. Failure to do so could cost you up to 5,000 USD in shipment penalties, and clearance at a U.S. port will not be possible.

4. You have to pay import clearance costs and taxes – make sure to check what rate applies in your state.

Do you feel overwhelmed by the documents and paperwork? You’ve got us!

As you can see, arranging the import of windows from Poland to the US by yourself is no easy task. Imagine having to:

- order the needed products from, for example, four manufacturers,

- schedule several separate meetings with different teams and take care of the deadlines yourself,

- pay four different invoices,

- organize four different shipments to arrive at one warehouse on the same time.

And we haven’t even reached the stage we described above, that is, all the documents and paperwork needed to deal with shipping the container and clearing customs in Poland.

What is the cooperation with debesto like?

- You choose from over 200 window systems. We most likely have what you’re looking for.

- You can calculate window prices for your investment free and online.

- You order products from verified Polish suppliers in one place.

- Throughout the entire process, you contact one salesperson and one technologist. You arrange several meetings together and choose the optimal solution. The salesperson is at your disposal throughout the entire process.

- You pay one invoice – if you want, with one transfer.

- We constantly monitor the order time and react in case of delays.

- We organize one transport and send the container to the USA. So you don’t have to worry about customs formalities in Poland, and your goods will be insured for the duration of the journey to the port. You can also choose the option to have the products delivered straight to the place indicated by you.

With us, the import of windows from Poland to the USA will be simple, smooth, well-organized and safe. We have delivered our products to over 1000 customers in 24 countries around the world. Windows ordered by debesto have already reached New York, New Jersey and the Seychelles many times.

Have any questions?

Still have doubts about whether it is worth importing Polish fenestration in your case? Reach us, and we will respond within 30 minutes during our business hours.

Get in touch with us